Brighton and Hove City Council has agreed a £1.1 billion budget for the coming year and voted to put up the council tax by 4.99 per cent.

Proposed cuts to spending on public toilets have been reversed. The ruling Greens said that they had listened and responded to the feedback after a public and political outcry over closures. And they had promised extra funds.

But the Greens were angered by a Labour move to switch £1.1 million to the budget for public toilets from the Hanover and Tarner Low Traffic Neighbourhood scheme.

The Greens accused Labour and the Tories of stripping the funding from plans to put in vital safety measures in Elm Grove, Queen’s Park Road and Egremont Place.

Labour added that it had also managed to save the “supported employment” service intended to help people with disabilities into work – and overturned proposed cuts to the lifeguard service and Volk’s Railway.

Labour said: “At tonight’s annual budget-setting council meeting, Labour councillors have secured some big wins for residents.

“Through campaigning, listening to residents and championing our communities, we have secured cross-party support for our plans that significantly improve the 2023-24 budget.

“Labour prepared a series of budget amendments to invest in basic services like public toilet refurbishments instead of flushing money away on vanity projects.

“Labour councillors made a series of passionate and persuasive speeches (and) worked cross-party to get these vital measures to improve outcomes for residents into the council’s budget.”

During the budget meeting, Green councillor Elaine Hills said: “We have already reversed toilet savings and put in additional money to that service. So this cannot be a genuine attempt to save public toilets.

“This is cheap electioneering at the expense of safer, greener streets, cleaner air and tackling the climate crisis.

“It was under a Labour administration that the wheels were set in motion for the climate assembly in which schemes to cut traffic in neighbourhoods were set as a priority.

“Labour have voted in favour of the liveable neighbourhood scheme so far but now suddenly are making this screeching U-turn.”

Councillors from all three parties spent six and a half hours debating the spending and saving plans for the 2023-24 financial year which starts in April.

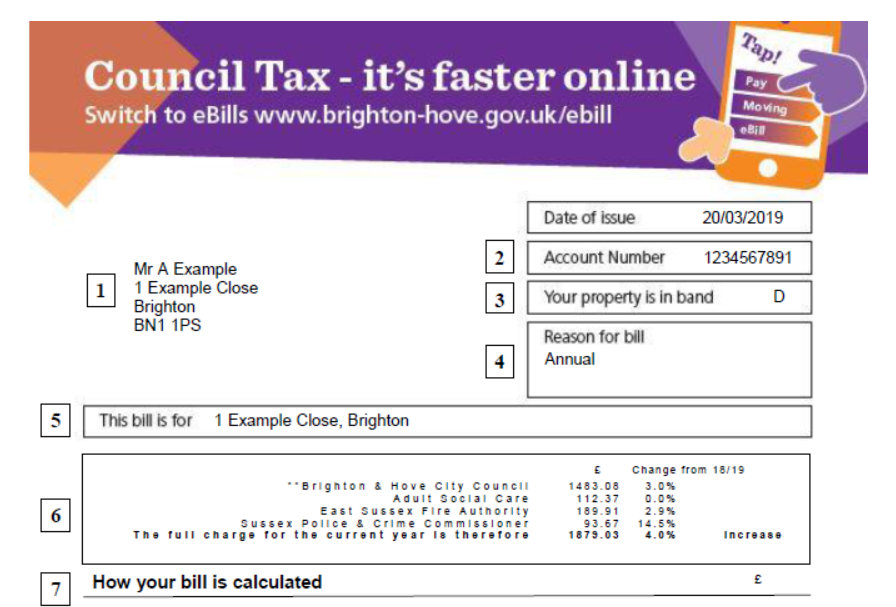

Council tax bills, which include precepts to help fund police and fire services, will rise by 5.2 per cent in total.

Two people or more in a typical band D property in Brighton and Hove can expect to pay £2,227.91 – or £185.66 a month – in the coming year. The annual bill is up by £109.60 from £2,118.31.

The council’s element of the council tax bill for an average band D home will rise by £89.60 from £1,794.03 to £1,883.63. About two fifths of the rise is earmarked for adult social care.

The Sussex police and crime commissioner’s precept for a typical band D council tax property will be £239.91 – up £15 from £224.91 in the current financial year.

And the East Sussex Fire Authority precept will add £104.37 to an average band D council tax bill – up £5 from £99.37 this year.

The council will almost certainly have to find further savings, with projected shortfalls in the medium term – from 2024 to 2027 – totalling £44 million.

The financial challenges have been made worse by a number of factors. These include an increasing demand for statutory services, high inflation, the continuing fallout from the coronavirus pandemic and the “cost of living crisis”, exacerbated by the war in Ukraine.

A city run by muppets with one of the highest council taxes in the UK. It doesn’t help that so many people on benefits don’t actually pay into the coincil tax sysyem and perhaps it’s about time that students started to be charged something as there are so many of them living in the city using up council resources. My council tax is already £2, 600 a year and this council can’t even deliver the basics. Blaming it on a 12 year Tory goverment is now getting boring to listen to, that obvioulsy contributes but the main reason is money managed by a bunch of stupid hippies with the wrong priorities.

I agree 100% thst students shoild pay some sort of council tax but it’s not a council decision not to charge them.

It’s the law and has been since council tax came in in the early 90s

Students will in general pay more tax after graduation and will have to repay all the financial support they received while studying. In addition to having no entitlement to any benefits (with a small number of exceptions). I think that’s enough contribution. Why the obsession with them paying “something” towards a tax that only contributes 15% of local government spending and would probably cost nearly as much to collect as it would raise?

Andy Richards

What evidence do you have that students will pay tax after graduation?

It would be logical that loans need to be repaid so not a reason not to pay anything now. Loans and grants is taken from Tax payers pots and is a benefit to the student and contributes nothing locally.

Students can claim any benefits the same as everyone else once they finished their courses and under certain rules can make claims now. Again a cost to tax payers and of benefit to the student and contributes nothing locally.

So far I’ve seen no evidence that students make any contributions at all.

Perhaps you could highlight where we benefit.

Great you say contributes only 15% of local government spending.

Perhaps if they paid some taxes that figure could be increased lessening the burden the rest of us have to pay, after all, CT is going up by 5% or so.

Pure speculation that it would cost nearly as much to collect. Taxes have been collected for hundreds of years without any problems under the current systems so unless you can prove otherwise, you have no argument there either.

After years of supporting the Greens the Labour group are now trying to red-wash the catalogue of Green policies they have continuously supported after losing power in 2020 due to the internal party scandals that saw Labour councillors ejected from the party and forcing an unelected Green administration take power. Dirty deals and convenient short term memory loss followed by the smell of a weak Green administration has resulted in Labour only now pointing out the unpopular and damaging policies they had previously supported without question for 3 years. #localmatters

The Greens took more votes than Labour city-wide at the elections of 2019, so I don’t see how you can claim that the current admin were ‘unelected’. Certainly they didn’t have more than 50% of the vote, but no admin in Brighton and Hove has. Blame that on the ridiculous electoral system, which fails to deliver what people really want.

Clive

I’m not sure you fully understand how these elections actually work.

We have 21 wards currently that provide a total of 54 seats.

It’s important to remember that not all parties put up a candidate for election especially in some strong wards meaning someone who might have voted for a Lib-dem or Labour may have voted Green instead.

You can quote the Greens took more votes, maybe they did, maybe not but remember only 86,584 out of 203,954 voters actually voted so less than half of residents.

How people vote and what reasons they may have for not voting varies from person to person, dissatisfaction with policies or events locally may have a bearing on people at the time.

So depending on how you wish to look at the stats and results, we could say, of the 86k odd who did vote, the majority didn’t vote green.

Dead right that most people did not vote Green in 2019. Also true to say that most people did not vote Labour. The point I was making is that the Greens polled more than Labour in terms of votes but wound up with one less seat owing to the strange workings of first-past-the-post.

I believe I am also right that no council admin has had more than 50% of the vote since the foundation of the combined Brighton and Hove authority in 1997, though Labour may have come close to it in the first elections. So if the support of the majority is your measure, no council administration of any stripe has been legitimate since then.

I do follow all of this quite closely and I am pretty certain Labour put up a full slate of candidates last time around. I think even the Lib Dems came close to doing that too.

Clive

You make some valid points and probably correct on no administration obtaining 50% and on if a candidate was presented for election.

I think voting by wards and councillors gaining a seat is a fair way of doing it.

If we were voting for a party instead of a person, I think the result might have been a bit different.

In my ward, I voted as many others did for the independent because I didn’t like the candidate put forward by the other parties, nothing personal but didn’t agree with their personal agendas.

Had the vote been for a party, then I would vote for the party that closely represents my preferences.

Maybe we should scrap the ward system completely and just vote for who we want, but realistically that probably wouldn’t work, because councillors wouldn’t have been voted for only the party, if that makes sense.

Voting for an individual I feel is a much better system.

Putting numbers aside, it is clear there is a split between Labour and Greens obtaining 39 seats between them. Neither party obtaining enough to have overall control of the city.

Just for fun, if we go by votes alone, and select the top 54, green still would not hold 26 seats.

I did a quick survey and we would have:

Greens 22

Labour 19

Conservative 12

Independent 1

Incidentally, the margin of 2 votes between Greens and Labour and Conservatives were several and the result might have given greens four less seats, Cons 1 less and labour the beneficiaries but still short by 2.

The headline here should be that the Hanover LTN scheme is to be scrapped, with the money saved going towards keeping our public toilets open.

This Labour budget amendment was passed with the help of the Torys, and is a win for common sense.

Over time, it had become clear that the LTN scheme had no defined benefits, and would simply mean longer journeys for local residents trying to get home, effectively increasing the traffic.

Given that Hanover is already a ‘living neighbourhood’ with little through traffic and that few residents supported the LTN, it seems entirely rational that the scheme was scrapped.

The Greens had responded with near hysteria:

“The Greens accused Labour and the Tories of stripping the funding from plans to put in vital safety measures in Elm Grove, Queen’s Park Road and Egremont Place.”

What vital safety measures?

Note that the three roads mentioned are arterial roads in this hilly area and our bus routes. It’s ironic that this Green council keep bringing in measures that slow up our public transport – which effectively encourages people back into their cars.

We really need some grown ups in charge of a city wide transport strategy.

How many of the current Green councillors are standing again? They all know the Greens in Brighton are a busted flush. Why? Because they’ve lied, cheated and deceived residents. It’s called Karma.

vital safety measure… Sure if you say so.

Like the road blocks outside schools where no one has ever had an accident because most schools are down quite side streets.

It’s only a vital safety measure if people are actually getting hurt and the area is some sort of accident black spot. By increasing the amount of traffic on those 3 roads mentioned by 200% would not make them safer.

I do hate it when people come up with undemocratic ideas and then hide behind a lie that’s it’s about safety. No it’s about the green adminstration hating any poor sod that has to drive in this city…

Glad labour and cons have finally got some guts and are stopping the gravy train if nonsense ideas that we residents are not consulted on, don’t want but are paying for.

Biggest safety issue on the roads in this city are the council communal bins that block visibility at junctions and are dumped sometimes over a meter away from the kurb

Graduates can avoid paying tax when they start to work? How does that work? Wish I’d known that 40-odd years ago!

You seem to like muddying the difference between students who actually are students (i.e. currently studying) and graduates (no longer studying and in the labour market) to make your points. The fact remains that *students* (see definition) cannot claim benefits. *Graduates* (see definition) can claim benefits depending on income and employment status, and – guess what? – they have to pay council tax (unless you’re going to claim that they have some magic way of avoiding that tax too).

When it comes to evidence, the DfE’s own research shows that graduates at the start of employment are earning £10,000 a year more on average than non-graduates, so clearly paying more tax.

In fact, when their loan repayments are factored in, graduates on £27,900 or more are paying tax at a rate of nearly 50%.

So you’re doing nicely out of what former students are paying in tax, not mention the benefits to you of those doctors, scientists, engineers, social workers, teachers, etc etc etc….

Council Tax is just that – a tax. It’s not a fee for services received by an individual. People don’t pay any income tax until their earnings reach a certain threshold and this seems consistent with people not paying -or paying less -Council Tax while they are low earners. That’s why we have exemption for students and a means-tested rebate scheme for others on a low income.

Andy Richards

Not sure if this comment was aimed at me, if it was would you please highlight where I said, ‘ Graduates can avoid paying tax when they start to work’

I made no reference to tax avoidance.

I certainly didn’t muddy students or graduates and certainly don’t need any definition.

The fact remains that *students* cannot claim benefits.

Facts are, under certain circumstances they can as you wrote earlier and copied for your benefit. In addition to having no entitlement to any benefits (with a small number of exceptions).

Graduates can claim benefits depending on income and employment status, so the same as everyone else, well done on that.

They have to pay council tax, if they fit the criteria yes they do, but again the same as everyone else.

When it comes to evidence, the DfE’s own research shows that graduates at the start of employment are earning £10,000 a year more on average than non-graduates, so clearly paying more tax.

Even a small child would understand that someone earning 10K more than someone else would pay more taxes, so the comment is irrelevant, because we all fit into certain tax bands.

Students take out loans the same as everyone else that have to be paid back, so again irrelevant.

The posting, was about students, not graduates paying Council taxes.

Until they graduate students make 0 contributions for the service’s they receive, they also benefit of those doctors, scientists, engineers, social workers, teachers, etc etc etc….

So you have no argument.

Correct, council tax is just that a tax.

Correction, council taxes are paid for service’s that individuals receive, rubbish and re-cycling for example.

People don’t pay any income tax until their earnings reach a certain threshold, correct, well done.

And yes this seems consistent with people not paying -or paying less -Council Tax while they are low earners. Well done again.

So going back to your original comment, ‘Students pay more tax’, isn’t factually correct. Students pay nothing until they graduate.

You seemed to be in need of “proof” that students will pay more tax after they graduate, which suggested to me that you thought graduates don’t pay any tax whatever they are doing. When the reality is that, in general, they will more tax than non-graduates over their working lifetime. The evidence for this is clear and irrefutable. Clearly you wont be satisfied unless they pay some council tax in the here and now while they are current students on a low income, no matter how iniquitous and impractical it is. A true triumph of dogma over common sense.

It isn’t going to happen – it’s the settled view of all parties that could realistically form a government in this country that there is nothing to gain in making students pay anything while they are still studying, Particularly as the Government compensates local authorities with high student populations with additional grant anyway. The Government also makes it clear that students are exempted precisely because they cannot claim state benefits.

Again, Council Tax pays for local services but it isn’t paid as a direct fee for services an individual receives. That’s why you have to pay Council Tax on any empty property you own in a given local authority even if you dont live in that area and dont receive any services there.