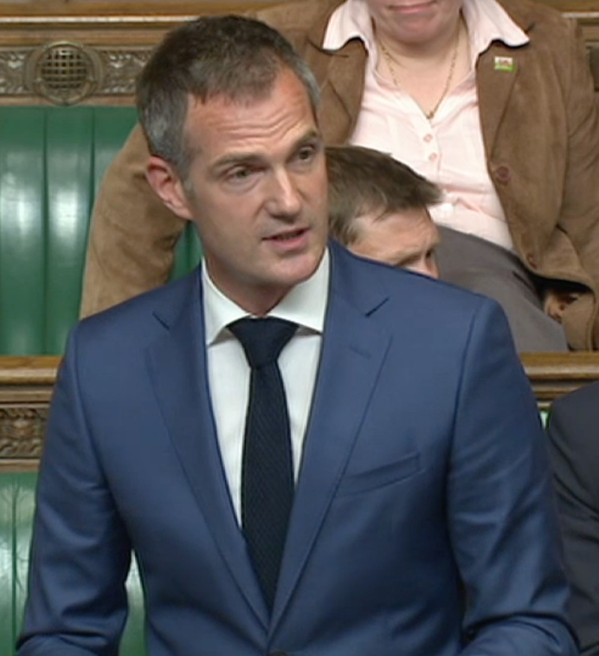

Hove MP Peter Kyle spoke up for small businesses and the self-employed in a House of Commons debate about tax changes this week.

Mr Kyle, the Labour MP for Hove, won praise from political friends and foes for his contribution to the debate which took place in Westminster Hall on Monday afternoon (25 January).

The Green MP for Brighton Pavilion, Caroline Lucas, intervened briefly a couple of times during the short debate.

It took place in response to a petition signed by more than 100,000 people. The petition was set up to protest about changes that will require small businesses and the self-employed to file tax returns four times a year instead of just once.

Even Britain’s biggest companies report their results only twice a year although the some huge American corporations are expected to file accounts quarterly.

Mr Kyle said: “I am the Member of Parliament for Hove, in the city of Brighton and Hove, which is one of the most entrepreneurial cities in the whole country.

“It also has one of the highest rates of self-employment in the country. The self-employment rate for 16 to 64-year-olds in work is 13.5 per cent, against a national average of 10 per cent, with 55 per cent of those people working in construction and 36 per cent in professional, scientific or technical trades.

“That shows the nature of self-employment in the south and self-employment is often a gateway to entrepreneurialism.

“Many of those self-employed people will go on to set up limited companies and become creators of wealth and employment, which drives the economy in Brighton and Hove.

“Statistics, however, do not cover the nature and challenges of making the move to self-employment or setting up a microbusiness.

“I became self-employed early in my career and then moved on to set up a limited company and a microbusiness.

“I co-founded a local business, which, looking back, was the most educative experience of my life.

“We learn a huge amount when we decide to jump in with both feet and set up a business, as an enormous breadth of understanding and skills goes into setting up an enterprise and becoming an entrepreneur.

“One key thing I learned from that experience was the nature of the risk involved in becoming self-employed or running a microbusiness.

“When we talk about people who are self-employed or run small businesses – sometimes as their friends but particularly as policy-makers – there is often an assumption that growth is linear and that money increases and risk diminishes each year as they get used to growing business and to the sector they are involved in.

“My experience was very different. Growth came on the back of extreme risk and extreme vulnerability, followed by a period of comfort.

“I then had to make a decision: should I stay in my comfort zone or take the decision to move out of it, back into extreme risk and vulnerability?

“The business jumped into periods of growth, with each jump and each improvement in annual figures coming on the back of a period of risk.

“As the business employed more people and its growth increased, the risk did not diminish. It got greater and greater because more depended on the business’s success.

“I have a huge appreciation for entrepreneurs who are growing businesses because there is no inevitability about the success of any business.

“It comes only on the back of extreme hard work and the ability to take risk on behalf of a business and the people who depend on it.

“Few people enter self-employment or set up small businesses with all the skills they need to do so. They sometimes lack skills in sales, admin, accounting, marketing, social media and product development.

“No one inherently possesses all those skills – particularly accounting – when they go into business or become self-employed.

“It is very unlikely that all of the 55 per cent of self-employed people in the city I live in who work in construction have all the administrative and accounting skills they need.

“Talk of changes to accounting and reporting can therefore be extremely intimidating to them.

“Gaps in people’s skills can be not just intimidating but terrifying. While people are learning skills, or worrying about lacking them, they are not doing.

“They are not out there selling, building the relationships that every business and self-employed person needs or winning new business.

“We must be mindful of that when we heap new regulation and changes in accounting and reporting on people who are self-employed or run small businesses.

“Talk of regulatory change can be intensely worrying for those who lack accounting skills. People who are worried become risk-averse and do not have the boldness of character we need in our entrepreneurs, particularly in the small business sector.

“The self-employed have a lot to worry about. One third of them will earn less than the minimum wage for two or three periods in a year.

“They have no statutory holiday and the working time directive does not cover their work.

“All of us will have heard stories from knocking on doors and talking to constituents at community events or reading their correspondence.

“I was struck by one particular story when I was campaigning during the general election. I knocked on the door of a tradesman who was self-employed and always worrying about the next contract.

“He told me, as he held his young baby in his arms, that he had never once been on a full week’s holiday with his wife and children.

“Instead, his wife takes the children away for a week once a year and he goes to meet them for the weekend because he cannot take the risk of not completing a contract.

“That type of experience is repeated throughout the self-employed sector and the microbusiness sector.

“People in those sectors make a lot of personal sacrifices in order to drive the economy, particularly in the south of England.”

Caroline Lucas said: “The honourable gentleman is making a powerful speech and he tells a strong story about the constituency of Hove which is relevant to my constituency next door.

“Does he agree that the pressures on small businesses are made even worse by the fact that they often struggle to get hold of HMRC (Her Majesty’s Revenue and Customs) advice right now, whether on the phone or by other means, because tax offices are closing?

“As well as having a bigger consultation on the issue, the government should look again at the resources going to HMRC.”

Mr Kyle said: “The honourable lady makes an incredibly important point. We have both been involved in local government issues and campaigned on national issues.

“Every moment that a self-employed person spends on the phone to the local council, HMRC or any other government department is a moment they are not spending getting new business, delivering new contracts and earning the money that will give them the security they need in the long term.

“We know that HMRC has a lamentable record on customer service which the minister graciously acknowledged in answering questions in the main chamber recently.

“I know that he will focus on that issue, and people such as myself and the honourable member for Brighton Pavilion (Caroline Lucas) will continue campaigning on it because it is extremely important.

“In the interests of fairness, I will also carry on campaigning against my council in Brighton and Hove, which is a Labour-run council, to ensure that it offers better services for, and better contact with, its local businesses and self-employed people.

“I am well aware that people who run big businesses in the city that I represent, whether American Express in Brighton Kemptown or EDF in my constituency of Hove, have a named contact in the local authority. That contact is called the chief executive.

“If the chief executive of one of those big businesses wants to get the council on the phone, they call the council’s chief executive.

“However, the drivers of our local economy – people who run companies that employ fewer than eight people which make up 90 per cent of the businesses in our city – do not have a named contact in the local authority.

“There are no consequences if a phone is not picked up or if a message is not returned. That symbolises how power is distributed in the wrong direction.

“It would be wrong if we designed and implemented policies that put people off wanting to become self-employed.

“The calls that members from all parties have made in this debate, imploring the minister to ensure that there is a period of consultation, have been extremely well put.”

James Cleverly, the Conservative MP for Braintree, intervened. He said: “I thank the honourable gentleman for sharing his experiences as an entrepreneur. As someone who has run a small business, I completely understand the point that he is making about fear of change.

“Does he therefore agree that if the government showed that the new policy could be intuitive and easy to understand and implement, many of the potential hurdles that he has highlighted could be put to one side?

“If some of the tech entrepreneurs who I know are prevalent in his constituency could be involved in designing the implementation and roll-out of the measure with the government, that would go a long way to addressing the issues that he has raised.”

Mr Kyle said: “I am extremely grateful for that thoughtful intervention, and I have some sympathy with the honourable gentleman’s points.

“However, when policies are thoughtful, intuitive and in the interests of business, businesses usually flock to take them up.

“In this case something has clearly gone wrong in one of two ways: either it is being communicated in the wrong way but it is a great policy or it is a poor policy that is being communicated in the right way but is not managing to hit home.

“The purpose of the debate is to decide which it is.

“The policy needs to be tested and communicated better. We need to ensure that people who run businesses – smart people who want to do the right thing by paying their taxes and ensuring that their businesses are not disproportionately burdened – are fully involved as the policy is implemented in the long run.

“In my view it certainly should happen in the long run because, at the moment, people are being put off going into self-employment or setting up their own business.

“Interestingly, on the train up here today, when I was speaking to my brother, who works as a postman in the Brighton Pavilion constituency, he told me that one of his colleagues had seen on the news that this debate was coming up and had talked about self-employment.

“His colleague was self-employed for a number of years – more than a decade – but moved away from it because of the fear of the accounting, bureaucracy and regulation that was being heaped on to self-employed people.

“The freedom that is associated with self-employment has diminished. As well as the burden of regulation, people fear not having the skills that they need and they fear the unknown.

“Because they are not a trained accountant or an experienced administrator – rather, they are a skilled labourer – they fear that they might step outside regulatory measures without being aware of it.

“That was enough to drive my brother’s colleague away from self-employment and back into paid employment.

“We should be wary of that because it would be a huge shame if entrepreneurship were to become the preserve of the middle classes.

“I do not believe that entrepreneurial spirit is class-based or education-based. It is evenly distributed, even though it is not evenly expressed in our economy.

“Public policy on the self-employed needs to be got right, particularly for people who run small businesses or microbusinesses.

“At the moment, I do not believe that government policy across the board is on their side.

“Let us take one example – the much vaunted, much hyped productivity plan, which I know the minister is keen to refer to often in the chamber and in the media.

“It is interesting that in the government’s flagship productivity plan there is not one single mention of the self-employed who make up 15 per cent of the workforce and number 4.5 million people.

“The fastest-growing employment trend in our country does not warrant a single mention in the productivity plan.

“In my constituency there is a fantastic business called Crunch, which has been set up specifically to supply accountancy services to people who are self-employed or running microbusinesses.

“I know that the honourable member for Brighton Pavilion went to visit a couple of weeks ago which was absolutely fantastic.

“It now provides services not only right across our city but right across the south of England and it is great that people are starting to notice just how fantastic the business is and how important its services are.

“It provides light-touch, fast, responsive support to people setting up businesses.

“The great thing about being able to visit it is that because it has thousands of customers, it can harness insight into real-time trends in self-employment and see the impact of public policy on the small business and self-employed sector.

“I know that quite often, HMRC and government departments struggle to get real-time data on the impact of government policy.

“One prediction that Crunch makes about the negative impacts of policy is that the leap from 0 per cent to 7.5 per cent in basic rate dividend tax will hit lower-earning company directors the hardest.

“Those are probably self-employed people who are moving their company to limited status, have a very small number of employees and pay themselves through dividends.

“Everyone wants to make sure that the right people are paying tax but the proposal could have the most negative impact on people on lower incomes who run microbusinesses.

“For example, a limited company director paying themselves primarily through dividends would pay £1,528 more tax a year on pre-tax profits of £48,000, whereas a director with £78,000 of pre-tax profits would pay only £1,343 more.

“We can also see from the statistics that the change in income tax for a microbusiness from 2015-16 to 2016-17 will have a negative impact of 21 per cent on somebody earning about £40,000.

“The equivalent impact on somebody earning £58,000 will be minus 1 per cent.

“There is something regressive, not progressive, about the changes to dividend tax and we need to shift the tax burden so that it is progressive, not regressive.

“If the minister does so, I know that he will be met with support from both sides of the House. I would very much welcome his comments on that point.

“Crunch, the company in my constituency that I mentioned, has a proposal for the minister. I hope he will take it away with him because Crunch represents a large number of self-employed people and microbusinesses.

“It says that the transition will be most challenging for microbusiness owners ‘as it leads to a steep hike in tax overnight’.

“It proposes ‘either deferring the introduction of these changes for at least 2 years’ which would enable businesses to have time to adapt ‘or introducing a three- year credit to keep dividend taxes at 0 per cent for those business owners on the basic rate’.

“I support those proposals and I hope that the minister will consider them in the same spirit.

“It is difficult to devise policies that support self-employed people because many people go into self-employment because they enjoy the freedom.

“Increasingly, however, we see a trend whereby larger employers are restructuring and people are being forced into becoming self-employed at a time when they would otherwise not have done so.

“This area of policy is not dissimilar to youth unemployment in the challenges it provides for policy makers.

“Self-employed people, like young unemployed people, are hidden away behind front doors in neighbourhoods and communities.

“They often work from home so there are problems of connectivity and how they network as a group. It is certainly easy to overlook them.

“The fact that they are hidden and dispersed in neighbourhoods makes it difficult to target them as one group.

“It would be welcome if the government examined professional development which would not be burdensome and would link directly with the policy that the minister is considering.

“Self-employed people as a sector underinvest in their own professional development and other spending trends among self-employed people include a fall in pension contributions every year for the past five years.

“The key measures of their long-term strategic thinking about their own professional development show that there are challenges that are intrinsic to the self-employed.

“Anyone who goes into full-time employment with a company looks at the professional development that if offers. That is a key magnet for talent.

“Self-employed people are so worried about month-to-month living that they do not invest as they should.

“We must tackle the productivity challenge among the self-employed and microbusinesses.

“The government should launch a consultation into that so that we can work cross-party to get deep into what trends are emerging and how we can support the sector.

“The challenge of professional development would then be won.”

The next speaker, the Conservative MP for Morecambe and Lunesdale, David Morris, praised Mr Kyle as did former Labour minister Chris Leslie, who represents Nottingham East.

Mr Leslie said: “I commend all the speeches that we have heard so far, from across the party political divide, but particularly that from my honourable friend the Member for Hove (Peter Kyle), who touched on the spirit of entrepreneurialism that many honourable members speaking in the debate care about and has motivated them to take part.

“I think that it was the honourable Member for East Lothian (George Kerevan) who correctly said or implied that no one should turn their face against employing new technology to simplify or streamline what might otherwise be bureaucratic, wasteful paper-based systems.

“I do not think that that is really at the heart of the debate.

“I am less concerned about the shift from paper to digital than I am about the potentially even more seismic change from annual to quarterly reporting, updates, summaries, returns – call them what you will.”

Earlier Caroline Lucas questioned whether small businesses and self-employed people already keep track of their finances digitally.

She said: “Will the minister tell us what his evidence base is for asserting that any change to the requirements will not be cumbersome for them?

“The assumption is that they are already keeping track of things digitally but many constituents tell me that they are not. Therefore, the change will be a burden.”